What is an SR-22? An SR-22 is not an actual "type" of insurance policy, yet a form filed with your state.

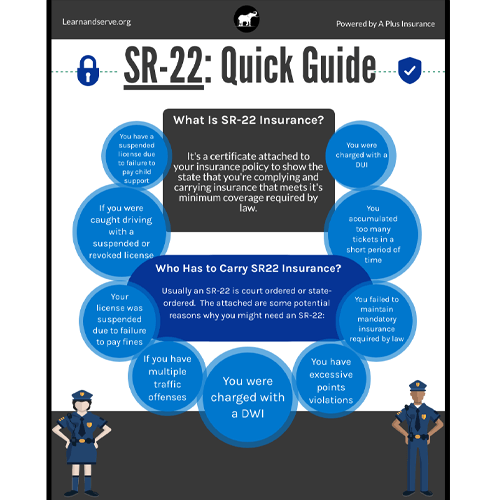

Do I need an SR-22/ FR-44? Not everyone needs an SR-22/ FR-44. Rules vary from one state to another. Normally, it is called for by the court or mandated by the state only for specific driving-related infractions. For instance: DUI sentences Reckless driving Mishaps caused by without insurance vehicle drivers If you require an SR-22/ FR-44, the courts or your state Automobile Division will alert you.

Is there a cost associated with an SR-22/ FR-44? This is an one-time charge you should pay when we submit the SR-22/ FR-44.

A declaring cost is charged for each private SR-22/ FR-44 we submit. As an example, if your partner gets on your plan as well as both of you need an SR-22/ FR-44, after that the filing fee will certainly be billed two times. Please note: The charge is not consisted of in the rate quote since the declaring fee can vary.

For how long is the SR-22/ FR-44 legitimate? Your SR-22/ FR-44 must stand as long as your insurance plan is active. If your insurance coverage is terminated while you're still needed to lug an SR-22/ FR-44, we are called for to alert the correct state authorities. If you don't keep continuous coverage you might lose your driving privileges.

Unknown Facts About Sr-22 - Insurance Glossary Definition - Irmi.com

If you're taken into consideration a risky vehicle driver such as one who's been founded guilty of several website traffic violations or has actually obtained a DUI you'll most likely have to end up being aware of an SR-22. What is an SR-22? An SR-22 is a certification of financial responsibility required for some vehicle drivers by their state or Homepage court order.

Depending on your situation and also what state you live in, an FR-44 might take the place of the SR-22. Just how does an SR-22 work?

1 It's up to your cars and truck insurance coverage firm to file an SR-22 type for you. You may have the ability to include this onto an existing policy, however remember that not every vehicle insurance company is willing to provide SR-22 insurance coverage. In this instance, you'll need to look for a new policy.

Furthermore, submitting an SR-22 is a key step in attaining a hardship or probationary certificate. 3 For how long will you require to have it? In the majority of states, an SR-22 is required for 3 years, however you must call your state's DMV to learn the specifically how much time you'll need it.

insurance companies insurance coverage insurance credit score dui

insurance companies insurance coverage insurance credit score dui

You may even have to begin the SR-22 process all over once more. Attempt to understand any other specifications that control your SR-22.

Some Known Incorrect Statements About Sr22 Insurance: Cost & Cheap Sr-22 Insurance Quotes - 101

3 The declaring treatments for the SR-22 and FR-44 are similar in lots of methods. A few of the important points they have in common include4,5,6: FR-44s are typically called for using court order, or you can validate your requirement for one by calling your neighborhood DMV. Your cars and truck insurer will certainly submit your FR-44 on your part with the state's automobile authority.

For context, the minimal responsibility protection for a normal chauffeur is only $10,000 for physical injury or fatality of someone. 7 Where to get an SR-22 If you assume you need an SR-22, get in touch with an insurance coverage representative. They'll be able to guide you through the whole SR-22 filing process and see to it you're meeting your state's insurance policy guidelines.

Which states need SR-22s? Each state has its very own SR-22 coverage requirements for drivers, and all are subject to alter. Contact your insurance coverage service provider to discover your state's existing needs as well as make certain you have ample insurance coverage. sr-22. Exactly how long do you need an SR-22? The majority of states need drivers to have an SR-22to verify they have insurancefor about three years.

Texas Kind SR22 Insurance policy is mandatory for a period of 2 (2) years from the date of conviction. An SR-22 is a 'certificate of insurance policy' that shows the Texas Division of Public Safety evidence of insurance policy for the future, as required by legislation (credit score). It is car liability insurance that requires the insurer to accredit insurance coverage to Texas DPS, and also the insurer need to notify DPS anytime the policy is terminated, ended or lapses.

Texas Minimum Obligation Amounts: Current minimum obligation protection quantities are $25,000 for bodily injury to or fatality of someone in one crash; $50,000 for physical injury to or fatality of two or even more individuals in one accident; $25,000 for damages to or devastation of property of others in one accident. underinsured.

Sr-22 - Insurance Glossary Definition - Irmi.com Things To Know Before You Get This

They validate for the Texas Department of Public Safety And Security (Tx, DPS) that a chauffeur has energetic car insurance. Still, not all chauffeurs need to get SR-22s. They generally just relate to those that dedicate major driving offenses as well as get high-risk driver designations. Given that risky chauffeurs are those most at-risk of submitting insurance cases, after that it is a necessity that they have protection - car insurance.

SR-22 plans only require the state's needed responsibility insurance coverage - department of motor vehicles. Still, candidates can usually add various other defense to their SR-22 policy, including: Accident insurance Extensive insurance coverage Uninsured/underinsured motorist protection Individual Injury Defense (PIP) coverage Roadside aid, lugging protection, rental automobile insurance coverage The more coverage you have, the less you might have to pay out-of-pocket adhering to crashes.

Motorists who do not own lorries, but still drive, could need to obtain a Non-owner SR-22. They need to purchase a non-owner car insurance coverage to sustain the SR-22. SR-22A certificates don't permit drivers to pay their policy's premium month-to-month. You have to pay your costs in at least six-month swellings. Motorists with a background of expired insurance coverage often have to obtain this alternative.

The majority of offenders can anticipate to have an SR-22 for as much as 3 years. During this time, you must keep continual liability coverage. Any kind of break in insurance coverage will certainly be reported to the state, resulting in the suspension of your certificate. In addition to protecting appropriate insurance coverage, drivers with an SR-22 standing must abide by website traffic laws and refrain from driving after alcohol usage.

SR-22 Insurance Coverage Info So, you need an SR22/SR -22 but aren't even sure what it is. Discover about an SR-22 including what it is, exactly how it influences you, as well as just how much it sets you back from SR22 Insurance coverage by Solo, TM, your regional and also on the internet insurance policy agents that can go shopping the very best prices for you despite your driving document. vehicle insurance.

The What's The Difference Between Regular Insurance And Sr22 ... Statements

Your state DMV can inform you the length of time you need yours. Many wrongdoers can expect to have an SR-22 for approximately 3 years. Throughout this time, you should preserve continuous liability insurance coverage. Any break in coverage is reported to the state and can result in the re-suspension of your Driver's Permit (this is why we call it the tattletale notice). division of motor vehicles.

credit score motor vehicle safety insurance group auto insurance insure

credit score motor vehicle safety insurance group auto insurance insure

Other SR-22 notes An SR-22 is not a "kind" of insurance, however rather an easy-to-get filing that claims you have your cars and truck insurance (sr22). You'll still listen to numerous individuals call it "SR22 insurance policy" but that is not accurate. Some auto insurance coverage firms will not provide an SR22 declaring, yet a lot of will.

For a free automobile insurance policy quote with an SR-22, request an on the internet quote or call us at 1-800-207-7656.---------------------------------- Solo Insurance Coverage and also "SR22 Insurance Coverage by Solo" where great prices and service fulfill.

ignition interlock driver's license auto insurance coverage sr-22

ignition interlock driver's license auto insurance coverage sr-22

division of motor vehicles dui credit score insurance vehicle insurance

division of motor vehicles dui credit score insurance vehicle insurance

Ever before question what is an Sr22? While Sr-22 insurance coverage isn't necessarily a kind of insurance coverage individuals desire by option, it is a demand by most states to prove that a specific individual has a certain degree of car insurance (insurance). Often, it is needed by a court or court after an individual has a mishap or obtains a DUI and does not have the bare minimum of legitimately required insurance at the time.

What is Sr22 Automobile Insurance Coverage? Some insurance coverage carriers do describe their SR-22 auto insurance intends as "high risk insurance coverage" for drivers that have had serious crashes with injured events or a background of driving under the impact. Sr22 insurance policy protection take care of the reality that the celebration getting it is a high danger client and often cares for verifying to the state that they are currently appropriately insured as well as able to proceed with driving once again.

What Is Sr22 Insurance? Do I Need It? - Getjerry.com Can Be Fun For Anyone

Not to appear judgmental yet after such actions, your condition as an SR-22 automobile insurance coverage client implies you are practically an unfavorable aspect with many insurance coverage carriers. Not all insurance provider will certainly cover SR-22 insurance customers. What Sr22 Insurance Coverage Does Currently, every person is entitled to a second chance to retrieve himself or herself and obtaining SR-22 insurance coverage is the very first step in the direction of doing that in the eyes of your service provider as well as the regulation (dui).

Is Sr22 Insurance Policy Forever? After a few years of no crashes or various other significant driving offenses, the majority of people will certainly no more need to file SR-22 kinds to their state to prove that they are insured as well as will no more need to pay the higher premiums that are typically related to Sr22 insurance coverage (sr22).

Do not take a look at the restrictive nature of SR-22 automobile insurance policy protection as something you will have to deal with for life - credit score. Contending the very least some type of responsibility auto insurance coverage is required by most states and also if you have been included in some kind of crash of incident where you didn't have any auto insurance policy, you will require to look into purchasing SR-22 vehicle insurance coverage because it will instantly submit a form with your state proving that you are covered.

This is, certainly, very severe as well as not something that should be disregarded. Driving is an opportunity and not a right and also part of having that privilege entails being appropriately guaranteed. Getting SR-22 car insurance will insure that you will be able to appreciate that benefit for several years to come whatever has actually occurred in the past (coverage).

, vice head of state of individual lines product advancement at Nationwide. Reinstating or maintaining your chauffeur's certificate is contingent on submitting an SR-22.

An Unbiased View of What Is Sr22 Insurance - Sr22 Form - Direct Auto Insurance

Generally, you'll require an SR-22 kind in the adhering to circumstances: You have actually been convicted for driving intoxicated (DUI) or driving while intoxicated (DWI)You remained in a crash you triggered, while driving without insurance, You drove while your license was put on hold or revoked, You've obtained way too many driving tickets in a short amount of time, You really did not pay court-ordered youngster support, Bear in mind that not all states call for an SR-22, and also some require an FR-22 (a comparable kind requiring you to bring more liability coverage than the state minimum) for certain offenses.<</p>