That said, for how long you require to maintain an FR-44 filed with the state relies on your particular circumstance (dui). What is the distinction in between SR-22 and also FR-44 in Florida? The difference in between SR-22 as well as FR-44 in Florida is that the state needs you to submit an FR-44 if you're founded guilty of driving drunk, while it needs you to file an SR-22 for other offenses, like reckless driving or causing an accident without insurance policy.

LLC has made every initiative to make sure that the details on this website is appropriate, but we can not assure that it is free of inaccuracies, mistakes, or noninclusions. All web content and services given on or via this website are provided "as is" and also "as offered" for usage. Quote, Wizard. com LLC makes no depictions or warranties of any kind, reveal or implied, regarding the operation of this website or to the information, web content, materials, or items included on this site.

The complying with may set off the requirement for a certificate: Just how much will an SR-22 certificate price? The certifications differ relying on your insurance policy carrier, yet they are typically under $100. How much time will I require an SR-22 certificate? It relies on what created the need for a certification. Three years is a great general rule, however consult with your attorney to figure out if it may be much longer or shorter (no-fault insurance).

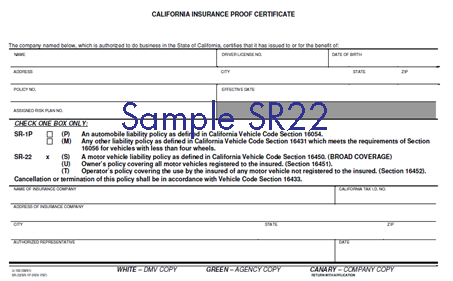

It is evidence that you have insurance, notwithstanding the truth that you obtained a DUI (or a chauffeur's license suspension, or a driving-related violation or criminal conviction). You'll intend to ensure to communicate to your insurance policy representative or insurance policy carrier that they need to send out proof of actual insurance coverage to the DMV, as well as a duplicate of the Certification of Financial Responsibility too - sr-22 insurance.

The certification commonly isn't an actual "certificate." Many of the moment, the certifications are sent electronically right from your insurance coverage firm to the DMV, so you won't in fact get something tangible in your hand. If you desire a physical duplicate, ask your insurance firm to send you one for your data, or to review.

Some Ideas on Alabama Dui Insurance Implications You Need To Know

deductibles sr22 coverage credit score motor vehicle safety deductibles

deductibles sr22 coverage credit score motor vehicle safety deductibles

Contact your insurance coverage firm to identify the real financial savings before terminating and also after that restarting insurance coverage. Take into consideration the extreme restrictions directly and employment-related of not driving for 90 days, one year, or also three years.

For additional information on this process, please see our web page on hardship allows - auto insurance.

insure bureau of motor vehicles insurance coverage insurance group

insure bureau of motor vehicles insurance coverage insurance group

Chauffeurs in the state of Arizona are called for to be covered by responsibility insurance. The insurance policy needs to be gotten with an accredited firm which has the permission to do business in the state. When a person is associated with an auto mishap in Arizona, or if they are drawn over by an authorities officer beside the road, they will be asked to reveal proof of insurance coverage. insurance coverage.

As soon as the suspension is over, the person will be called for to confirm monetary duty in order to get reinstatement of their automobile registration and their chauffeur's license. department of motor vehicles. Provided below are the standards for minimal protection required by law in the state of Arizona. insurance group. If policyholders are concerned regarding protection, they can acquire greater protection (bureau of motor vehicles).

This indicates that if several individuals are harmed in the mishap, then those who file first would obtain repayment as mentioned above. When the total payment is reached, the continuing to be parties will certainly have to file a match in order to get quantities over this quantity. insurance. The total amount spent for residential or commercial property damages is $10,000 "SR" represent Safety and security Duty legislation.

The Facts About How To Get Your Driver's License Reinstated Quickly - Youtube Uncovered

bureau of motor vehicles sr22 insurance credit score sr22 coverage no-fault insurance

bureau of motor vehicles sr22 insurance credit score sr22 coverage no-fault insurance

If your service provider hikes up your costs or if you have to find a new insurance firm, you might have to pay out substantially to acquire insurance coverage. Sometimes you might hear this kind of insurance coverage called an "SR-22 policy" or a "high-risk policy.

Texas charges an annual fee of $1,000 to $2,000 for the first 3 years complying with a DWI sentence if you want to preserve your driver's license. These expenses get on top of any kind of fines included in your sentence, court charges you need to pay, and also the legal expenses of fighting for a more beneficial end result in your Texas dui instance.

Once you are convicted of a DUI, the MVD may identify that you are a "risky" motorist as well as will require you to obtain an SR-22 or "high risk" insurance (coverage). This is a Financial Duty insurance policy form that your insurer files to verify that you have the minimum obligation insurance required by law to the DMV on a month-to-month basis.

The state generally requires individuals with a DUI conviction to bring an SR-22 insurance coverage for 3 years after the sentence. Your insurance firm is mandated to notify the state of adjustments in your vehicle insurance coverage policies, such as revivals and terminations, within this period (department of motor vehicles). People with a DUI sentence aren't the just one that are mandated to file for an SR-22.

dui insure credit score credit score ignition interlock

dui insure credit score credit score ignition interlock

The insurance business files an SR-26 insurance policy to notify the state that you have actually paid your dues (car insurance). Make certain to have actually a relied on insurance policy agent who has expertise with SR-22 insurance coverage in the state of Arizona, Insurance Coverage Protection under the SR-22The minimum responsibility insurance coverage in Arizona and, by expansion, the minimum protection assured by an SR-22 insurance Click to find out more coverage is the 15/30/10 insurance:$ 15,000 injury or death of someone$ 30,000 injury or death of even more than a single person$ 10,000 damage to building, You can go with a higher insurance coverage, yet choosing the minimum will maintain the expenses as low as feasible. car insurance.

What Does What Is Sr22 Insurance - Detailed Guide - Carinsurance.com Do?

The expensive bit is the insurance premiums that comes with a DUI sentence on your MVD document they're typically costlier than ordinary policies. And you have to maintain the insurance protection for the needed period. insurance companies.

Which Wisconsin Insurance Policy Companies Deal the Most Inexpensive SR-22 Insurance? The intensity of the driving infraction makes SR-22 insurance coverage much more costly than a regular vehicle insurance policy. Only a small charge is required to submit the SR-22 type, yet the connected violation can drive up SR-22 insurance rates (no-fault insurance). In Wisconsin, minimum coverage SR-22 insurance prices around $958 each year typically for a DUI.

That Demands SR-22 Insurance in Wisconsin? And for Exactly how Long Do They Need It? Every state has its very own regulations that determine which infractions require SR-22 insurance coverage - dui. In Wisconsin and also other states, you'll require to submit for SR-22 protection if you're convicted of any of the following serious offenses: Negligent driving, DUIDriving with a put on hold license, Driving without insurance protection, Minor infractions typically do not need an SR-22.